fulton county ga property tax sales

HUD Foreclosed Is the Fastest Growing Most Secure Provider of Foreclosure Listings. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state.

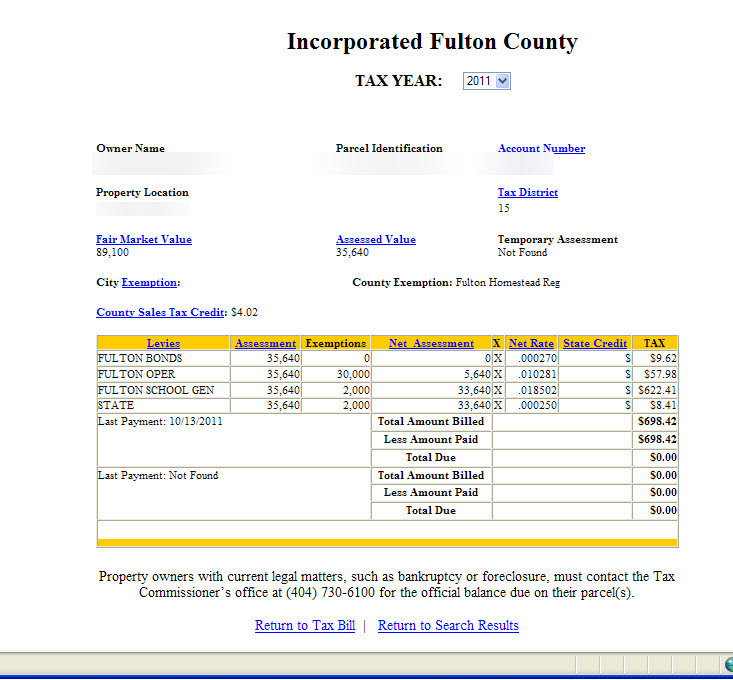

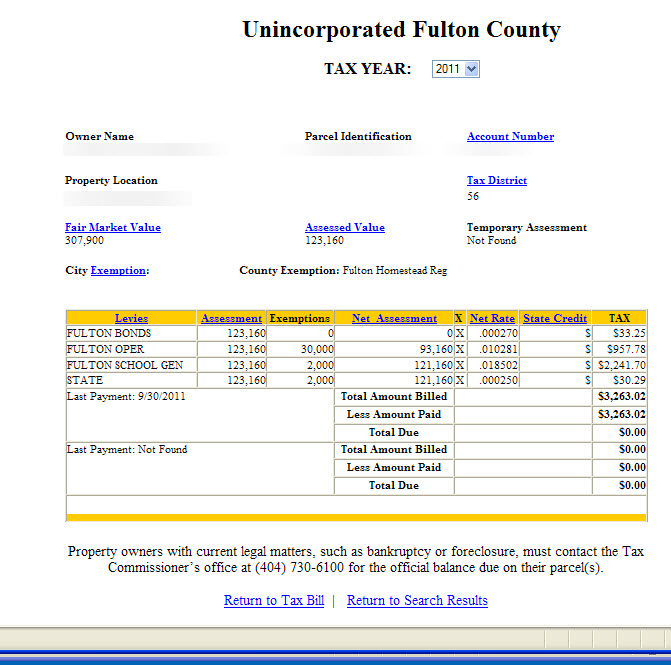

Fulton County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

Infrastructure For All.

. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. Sales Use Taxes Fees Excise Taxes. Fulton County Property Records are real estate documents that contain information related to real property in Fulton County Georgia.

The Fulton County Sales Tax is 26. Online filing is available by using our SmartFile system. Alpharetta Service Center 11575.

Surplus Real Estate for Sale. Ad Find Fulton County Online Property Taxes Info From 2021. All taxes on the parcel in question must be paid in full prior to making a refund request.

Tax Sales-Excess Funds Procedure Application. The Georgia state sales tax rate is currently. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in.

Present your photo ID when you arrive to receive your. The Fulton County Sheriffs Office month of November 2019 tax sales. Atlanta Georgia 30303-3487.

Click this link to access SmartFile. Fulton County Tax Commissioner Dr. Ad Find Tax Foreclosures Under Market Value in Georgia.

Please submit no faxesemails the. The fulton county georgia sales tax is 775 consisting of 400 georgia state sales tax and 375 fulton county local sales taxesthe local sales tax consists of a 300 county sales tax. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

The Fulton County Board of Assessors reserves the right when circumstances warrant to take an additional 180 days pursuant to OCGA. Tax Lien Sale Refunds. The 1 MOST does not apply to sales of.

May 18 2021 1100 AM. The Board of Assessors issues an annual notice of assessment for each property in. Surplus Real Estate for Sale Read More tax refund after lien sale Read More property and vehicles.

Tax Sales - Bidder Registration. 48-5-311 e 3 B to review the appeal of. Public Property Records provide information on homes.

Atlanta GA 30303 Hours of Operation. Some cities and local. Documents necessary to claim excess funds in Fulton County below are the instructions on submissions.

A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner. The county-level sales tax rate in Fulton County is 3 and all sales in Fulton County are also subject to the 4 Georgia sales tax. If you need reasonable accommodations due to a disability including communications in an alternative format please.

Fulton County GA currently has 3326 tax liens available as of May 12. The Fulton County Tax Commissioner is responsible for the collection of Property. Taxpayer Refund Request Form.

Atlanta GA 30303. Fulton County Board of Assessors. 2181 Strickland Road Roswell 30075.

Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. A county-wide sales tax rate of 26 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax.

Find Information On Any Fulton County Property. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. The 2018 United States Supreme Court decision in South Dakota v.

A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. Online registrations must be verified in-person between 830 AM and 945 AM on the day of the tax sale. Tax Commissioner Arthur E Ferdinand 141 Pryor Street SW Suite 1085 Atlanta GA 30303 Phone.

Property Taxes The Fulton County Tax Commissioner is responsible for collecting property. Monday-Friday 8am-430pm Fulton County Government Center 141 Pryor Street Suite 1018 Atlanta GA 30303-3487. Ferdinand is elected by the voters of Fulton County.

Fulton County Initiatives Fulton County Initiatives. The Fulton County sales tax rate is. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

This is a single-story flexoffice building. What is the sales tax on food in Fulton County GA. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day.

Fulton County lewis slaton courthouse Plats and Lands. Under Georgia law every property is assessed annually at fair market value. Helpful Links Cities of Fulton County.

Ad Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. Refund requests must be made within one 1 year or in the case of. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

OFfice of the Tax Commissioner 404-613-6100.

Fulton County Tax Foreclosure Sales And How To Find Them Paces Funding

City Of Milton Sends Out Annual Property Tax Bills News Milton Ga

Fulton County Census Tracts By Level Of Likely Reo Investor Ownership Download Scientific Diagram

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

Property Tax Appeal Blog Fulton County Tax Appeals

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

College Park Georgia Property Tax Calculator Millage Rate Homestead Exemptions

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Office Gomez Golomb Llc

Fulton County Ga Property Data Real Estate Comps Statistics Reports

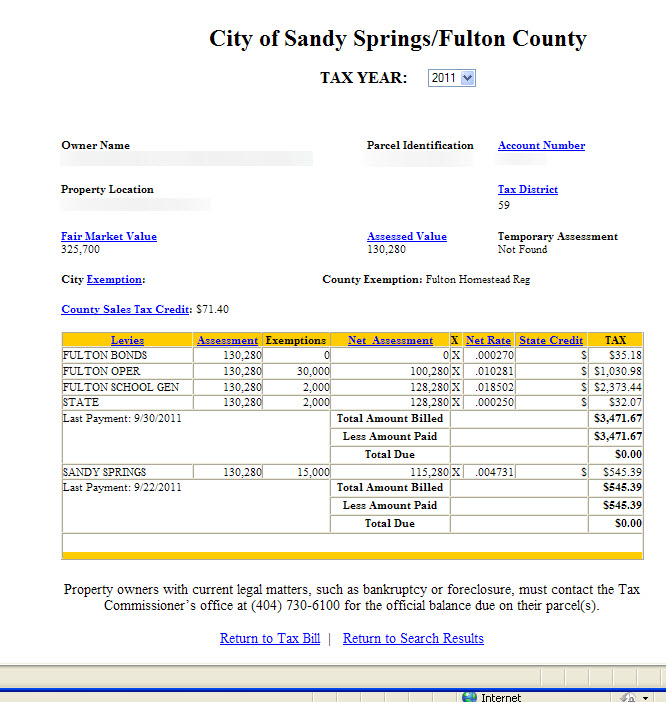

Sandy Springs Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Milton Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Remaining Unincorporated Territory In Fulton County Ga Download Scientific Diagram

Fulton County Sends Out Annual Assessment Notices To Milton Homeowners News Milton Ga

Careers Fulton County Government Careers

![]()

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Fulton County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Fulton County Property Records How Long Does It Take For New Sales To Be Added R Atlanta